There is a fear of losing in today’s uncertain market. But the good news is, Wealth Planning is your shield to not only overcome the fear of investing but also long-term safety. Whether you are a beginner investor or someone who is scared because of the past, these strategies for building wealth will help you stay focused and win big.

With careful planning and the will to win, it is possible to beat fear with planning and systematically making money is achievable.

1. Understand the Source of Investment Fear

Fear is mainly derived from ignorance

Most of the investors stay away from investing out of fear of the unknown. Knowledge of how money multiplies using Wealth Planning and a knowledge of the basics of mutual funds, SIPs, stocks, and debt securities will do away with the fear of investment.

Education turns uncertainty into action

Do something by knowing about VSRK Capital’s services. Our advisers are AMFI-registered and can make even the most complicated financial products easy to understand for you.

2. Set SMART Financial Goals

Definite goals avoid anxiety

If your goals are unclear, your plan is weak. Formulate SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound.

Break massive goals into bite-sized milestones

Rather than saying “I want to be rich,” make a specific goal, such as: “I want ₹50 lakhs in 10 years for my child’s education.” This brings wealth planning into the picture and helps you overcome the fear of investing.

3. Build an Emergency Fund

Create safety before pursuing growth

Absence of a financial cushion typically creates fear and bad choices. Set aside 3–6 months of expenses in a liquid mutual fund before you apply strategies for building wealth. This action provides you with security and overcomes the fear of investing by putting emergency funds in place well ahead of time.

Emergency funds conquer fear with foresight

An emergency fund is a cash buffer against unexpected events such as loss of employment or medical crises. It prevents the stress of needing to liquidate long-term investments. It provides liquidity and ensures confidence, and acts as an insurance against fear, making wealth planning more effective and less traumatic.

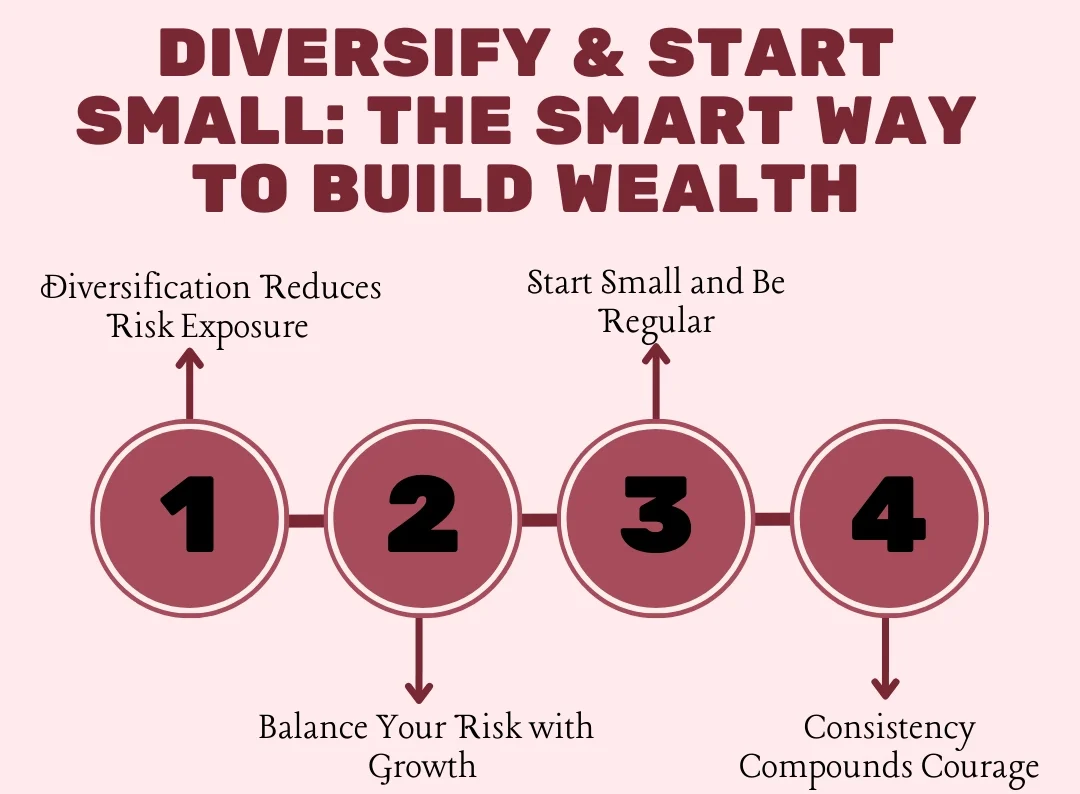

4. Diversify Across Asset Classes

Diversification reduces risk exposure

A diversified portfolio is a vital way of accumulating wealth with very minimal risk. By diversifying investment in equity, debt, gold, and real estate, you minimize the effect of market fluctuations. This overcomes fear of investing and enhances confidence in your long-term planning process.

Balance your risk with growth

Good wealth planning does not put all its eggs in one basket. Spread your investments across different assets to reduce risk and stabilize returns. This tactical action helps you overcome fear of investing, ensures stability, and opens the door to long-term financial success, especially during volatile market times.

5. Start Small and Be Regular

SIP: A Beginner’s Best Friend

You need not make a lump sum. Begin with a minimum of ₹500/month in SIP (Systematic Investment Plan). This avoids the fear of market timing and enables wealth to accumulate slowly but surely.

Consistency compounds courage

Discipline, which is developed through consistent investing, reduces emotional decisions, and confidence is achieved. This steady approach is a time-tested method for building wealth and overcoming the fear of investing.

Need help in creating your very first SIP? Reach out to us and let’s start.

6. Take Professional Help

Don’t fly solo

Collaborate with professionals who will tailor a wealth planning strategy for your income, risk tolerance, and objectives. VSRK Capital is here to offer professional help with clarity.

Planners conquer fear with facts

Financial planners provide impartial advice, assisting you in setting realistic goals, estimating risks, and optimizing approaches. Expert expertise eliminates emotional prejudice and cuts down on wealth planning decisions.

7. Review and Revise Periodically

Wealth planning is an ongoing activity

Markets and life never remain static. Monitor your portfolio every 6 months and alter if needed. Rather than worrying about making SIPs, rebalance them to come back on track.

Adaptability conquers fear

There is a need for flexibility in wealth planning. Periodic reviews keep you ahead of market changes. By planning, you overcome fear and grow confidently.

Bonus Tips to Enhance Your Wealth Planning Strategy

Monitor Your Expenses

Budgeting is the starting point towards wealth planning. When you know your expenses and revenues perfectly, you are in control. The clarity overcomes fear of investment and redirects excess funds to long-term wealth generation.

Automate Your Investments

Auto-debits on SIPs or regular deposits eliminate the inconvenience of payments made manually. Automation instills discipline in investment, overcomes the fear of investment by establishing a certain regular investment, and aids smooth progress in your wealth planning journey.

Learn from Mistakes

It is sad to lose money, but do not lose heart. Identify what went awry, make adjustments if necessary, and proceed. In that way, you will overcome the fear of investing and grow your wealth planning for future success.

Who Must Make Wealth Planning a Priority?

-

- Young earners: Begin early and utilize compounding and compound interest.

- Mid-career professionals: Risk versus long-term objectives.

- Retirees: Safeguard wealth and create passive income.

VSRK Capital: Your Trusted Partner in Wealth Planning

At VSRK Capital, we offer customized wealth planning strategies for building wealth while helping clients overcome a fear of investing. Our AMFI-registered professionals are with you at every step, like planning, execution, review, and growth.

Ready to begin? Reach out to us today.

Want to visit? Here’s our Google Business Profile.

Learn more about our services, Fixed Deposit, Portfolio Management, NCDs and Bond, Stock Market, Tax Saving, Structured Products, Mutual Fund,

Conclusion: Overcome Fear with Intelligent Wealth Planning

Fear is a natural emotion, but it has no place dictating your financial destiny. You can be serene, secure, and in command with the correct approach to wealth planning. Disassemble your fear into pieces and deal with it with discipline, education, and advice. Begin modestly, be tenacious, and have faith in the process.

The ideal time to plant a tree was 20 years ago. The second-best time is today.