In the fast-paced world of today, financial protection is a top priority. Recognizing the importance of life insurance and health insurance is crucial for securing your loved ones’ future. These insurance policies are not merely monetary vehicles but intrinsic elements of a sound financial plan. We at VSRK Capital stress the importance of incorporating these insurances in your financial planning to provide overall protection.

Understanding the Importance of Life Insurance

-

-

Financial Security for Dependents

-

Life insurance provides your family with financial support in your absence, covering essential needs like education, daily expenses, and housing, ensuring their lifestyle and dreams remain uninterrupted.

-

-

Debt Repayment

-

Outstanding debts like home loans, car loans, or personal loans are cleared with life insurance payouts, preventing any financial stress or liability from falling on your family after your demise.

-

-

Peace of Mind

-

Having life insurance provides peace of mind knowing that your loved ones are financially set, even if something untoward occurs, eradicating fear about their future financial security.

-

-

Tax Benefits

-

Your premiums paid for life insurance are tax-deductible as per Section 80C, saving you taxes and also providing financial security to your family with a wise financial decision.

-

-

Wealth Creation

-

Some life insurance policies provide protection as well as investment, allowing policyholders to build wealth over the years while remaining financially protected for the duration of the policy.

-

-

Business Continuity

-

Life insurance facilitates easy business succession planning, providing partners or heirs with money to run the business or purchase your stake in the event of the owner’s sudden death.

-

-

Retirement Planning

-

Certain life insurance policies offer maturity returns or annuity, providing a consistent flow of funds post-retirement, bringing stability to your financials in your post-work years.

-

-

Legacy Planning

-

Life insurance enables you to leave wealth for posterity, securing your family’s long-term future and creating a lasting financial legacy beyond your own lifetime.

Discovering the Benefits of Health Insurance

Health insurance is an essential element of financial planning, providing several advantages:

Thorough Coverage: Health insurance provides hospitalization cost coverage, surgeries, and other treatments, lowering the out-of-pocket costs.

Preventive Treatment: Most policies come with preventive treatment, promoting routine check-ups and early disease detection.

Cashless Hospitalization: With its extensive network of hospitals, policyholders can enjoy cashless hospitalization, making hospitalization easy.

Tax Relief: Premiums are tax-deductible under Section 80D.

Financial Security: Health insurance protects your money from being spent on unforeseen medical conditions.

General Insurance Definition and Its Significance

General insurance refers to all types of non-life insurance policies, offering protection against unexpected events. Here is a summary:

Definition: General insurance can be defined as policies offering financial security against losses except those against life insurance.

Types: This includes health insurance, motor insurance, home insurance, travel insurance, and more.

Purpose: These policies are designed to protect assets and provide financial support during emergencies.

Importance: General insurance ensures that individuals and businesses can recover from unexpected losses without significant financial strain.

Regulation: In India, general insurance is regulated by the Insurance Regulatory and Development Authority of India (IRDAI), ensuring policyholder protection.

Key Features of Health Insurance

Knowledge of the health insurance features is useful in choosing the correct policy:

Sum Insured: The highest amount paid by the insurer for a claim.

Network Hospitals: A list of hospitals where policyholders can take cashless care.

Pre- and Post-Hospitalization: Medical expenses for pre-hospitalization and post-hospitalization.

Daycare Procedures: Medical procedures that don’t involve 24-hour hospitalization.

No Claim Bonus: An Incentive for not claiming anything throughout the policy period, usually leading to a higher sum insured.

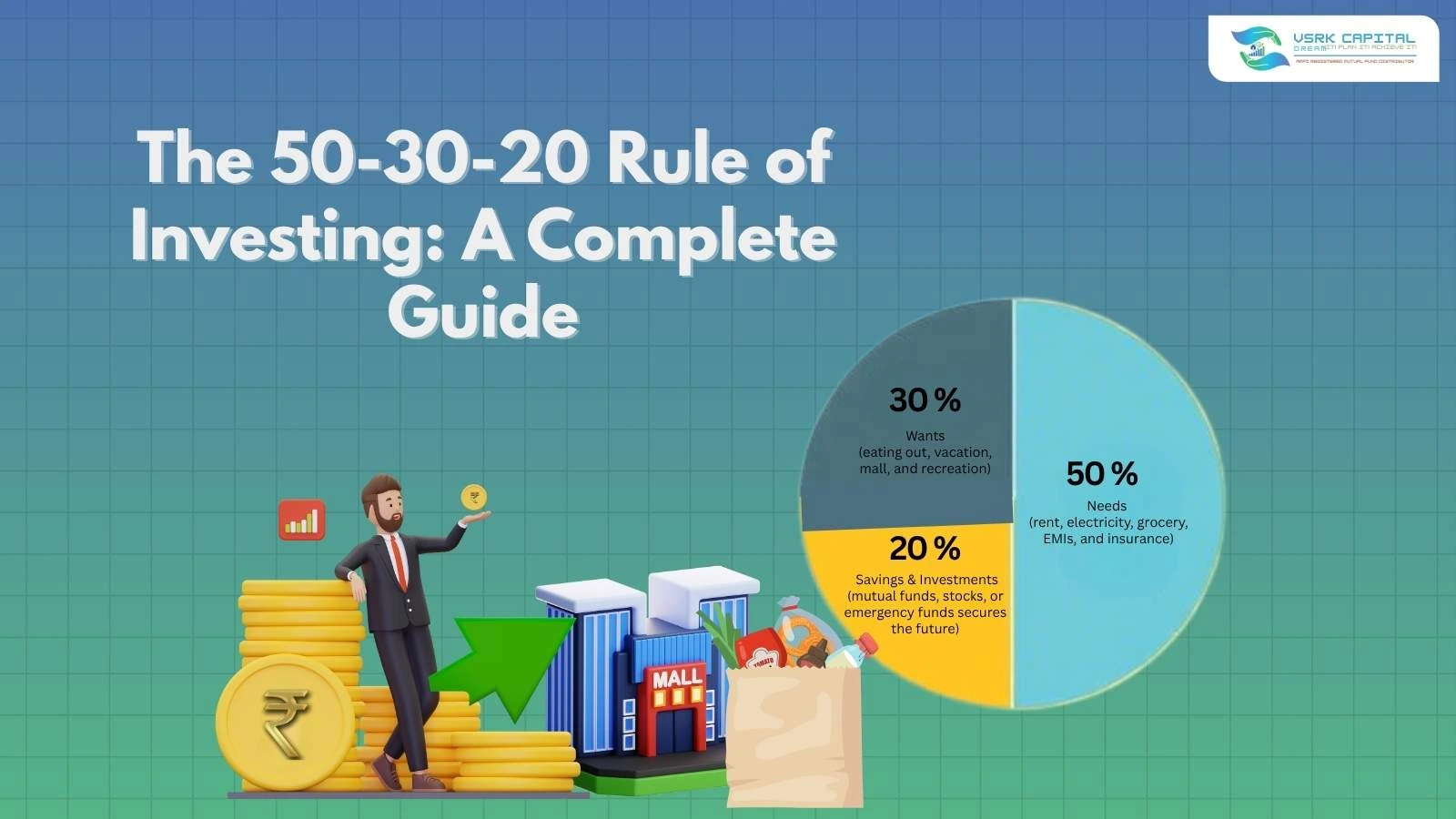

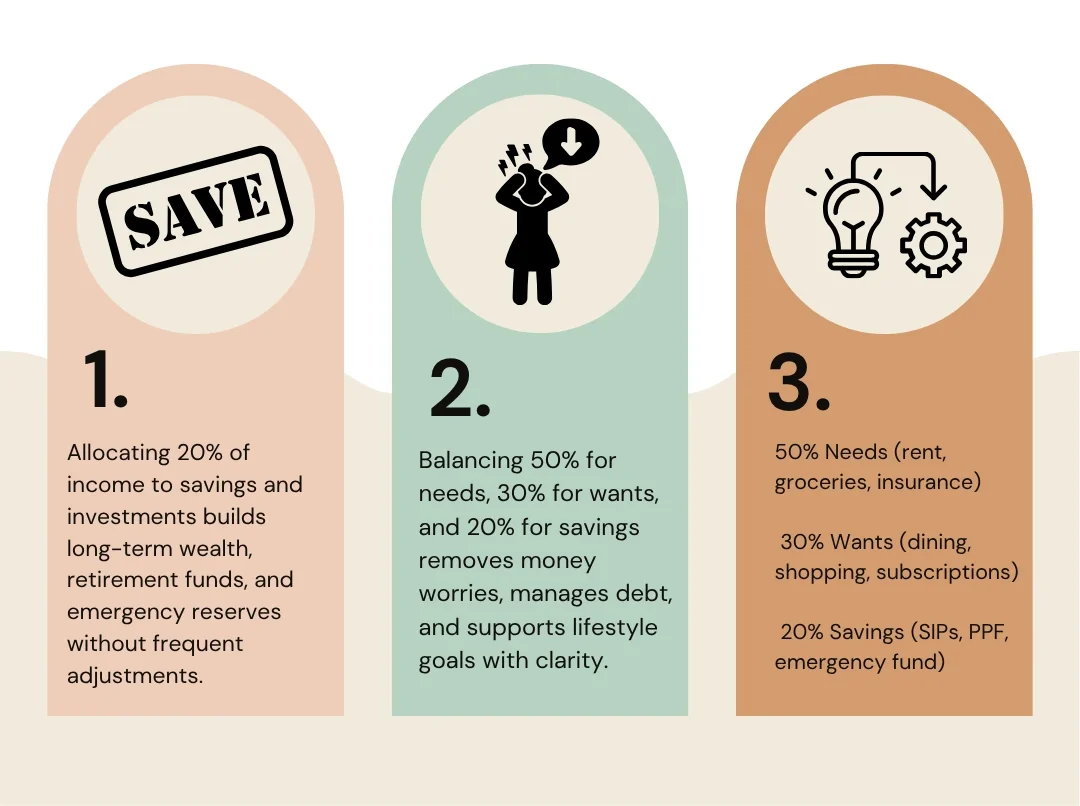

Incorporating the 50-30-20 Rule in Insurance Planning

The 50-30-20 Rule is a budgeting rule that distributes:

-

- 50% of income on necessities (such as insurance premiums).

- 30% on discretionary expenditure.

- 20% towards savings and paying debt.

By distributing a fraction of your income towards insurance premiums, you get insured while not affecting other financial objectives.

How VSRK Capital Supports Insurance Planning

Our Company, VSRK Capital, provides:

Individualized Insurance Solutions: Customized life and health insurance policies to suit your requirements.

Professional Advice: Expert guidance in the selection of the appropriate policies.

Comprehensive Financial Planning: Putting insurance as part of your overall financial plan.

Support After Sale: Policy renewals, claims, and updates support.

Conclusion

Knowing the value of life insurance and medical insurance is crucial to financial security. Not only do these policies protect you, but they also generate wealth and peace of mind. By including them in your financial strategy, you ensure a secure future for yourself and your family.

FAQs

Why is life insurance necessary?

It ensures your family’s financial security when you are not around, paying bills and debts.

What are the benefits of health insurance?

It provides financial security against medical emergencies to ensure the availability of good-quality healthcare.

What is general insurance?

General insurance involves non-life policies such as health, motor, and house insurance, covering against the risk of some unforeseen event.

What are the characteristics of health insurance?

Sum insured, networked hospitals, pre- and post-hospitalization charges, and no claim bonuses are some of the notable features.

How does the 50-30-20 Rule apply to insurance?

Spend 50% of income on necessities, such as insurance premiums, to keep financial protection without impacting other objectives.

Can VSRK Capital assist with insurance planning?

Yes, we offer customized insurance solutions and professional advice to incorporate insurance into your financial plan.

Are there tax advantages for insurance premiums?

Yes, premiums for life and health insurance are deductible under Sections 80C and 80D, respectively.

For further details and personalized support, visit us at VSRK Capital, reach out to us at our Contact Page, or search for us on Google.