In the fast-paced world of mutual funds, sector funds and thematic mutual funds are two terms that confuse investors. Both are equity-based investment strategies with the potential to deliver high returns, but both carry varying strategies and risks.

In this in-depth guide by VSRK Capital—a Registered Mutual Fund Distributor of AMFI—we simplify the differences, similarities, benefits, and when you should invest in either.

What are Sector Funds?

Sector mutual funds are mutual fund schemes that invest in a particular sector or industry of the economy. For example, a pharma sector fund will only invest in pharma companies, whereas a banking sector fund will invest in financial institutions.

These funds have a high growth potential when a specific sector is thriving. But they are equally dangerous when the sector performs badly.

Important Features of Sector Funds

-

- Risk of Concentration: Investments are limited to a single industry.

- Potential for High Returns: Can generate high returns if the selected sector performs better.

- Timing is everything: The Timing of entry and exit is critical due to the cyclical nature.

- Needs Sector Knowledge: Investors need knowledge about sector trends.

Investors having good insight into a particular sector are able to benefit from market direction through sectoral mutual funds

What are Thematic Mutual Funds?

Thematic mutual funds are more than one sector. They invest across various sectors with a common theme in mind, like consumption, ESG (Environmental, Social, Governance), or rural development.

Take, for instance, a technology theme that encompasses IT, electronics, digital infrastructure, and telecom—all such areas working towards a common trend.

Features of Thematic Mutual Funds

-

- Diversified Sector Exposure: Spread across several industries with a common theme.

- Long-Term Potential: Constructed around new trends or economic changes.

- Moderate Risk: More diversified than sector funds.

- Strategic Allocation: Macro-economic outlook and policy changes-driven.

Investors seeking strategic diversification and thematic growth narratives may find thematic mutual funds an apt choice.

Sector Funds vs. Thematic Funds: Key Differences

Let’s analyze the key differences to guide you to the correct choice:

Sectoral mutual funds are best when you have a strong belief in the growth of an industry. Thematic mutual funds, on the other hand, give wider exposure with a shared objective.

When To Invest in Sector Funds?

Sector funds may work well in certain scenarios:

-

- Market Cycle Supports a Sector: Like a boom in the technology sector or the expansion in banking.

- Policy Push: Government intervention or reforms in an industry.

- Sectoral Trends: Increased demand, innovation, or exports in the industry.

But they are not suited for long-term passive investors. These funds require active tracking and fast decision-making.

If you feel sure about the knowledge of an industry and have a good sense of the market, sectoral mutual funds can be very lucrative.

When to Consider Thematic Mutual Funds?

Thematic mutual funds are more suitable for:

-

- Broad Economic Trends: Such as digital transformation, infrastructure, or ESG.

- Long-Term Investors: Who wish to surf big macro trends.

- Diversification: Within a thematic, structure-based strategy.

Even when one sector disappoints, others within the theme can catch up with the returns. Thus, thematic funds present a more well-balanced risk than pure sector funds.

Advantages and Disadvantages of Sector Funds and Thematic Funds

Sector Funds

-

- Advantages: High growth potential, Focused exposure, Easy to understand for industry experts

- Cons: More risky because of a lack of diversification, Sensitive to government policies, economic cycles, not ideal for beginners

Thematic Mutual Funds

-

- Pros: Wider investment universe, Strategic, forward-looking investing, marginally more balanced risk

-

- Cons: Still focused on risk, Difficult to measure drivers of performance, Theme may not mature

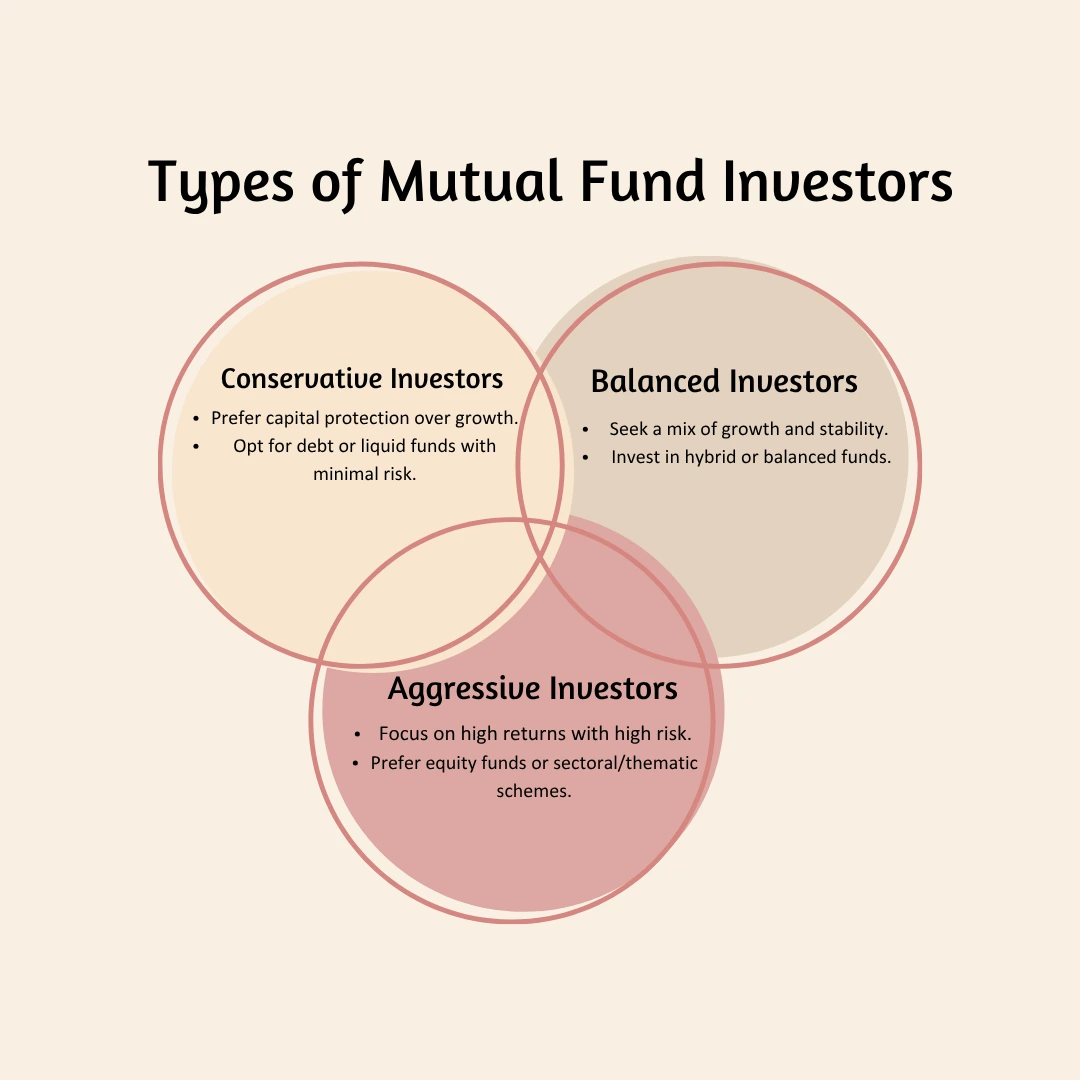

Which One Should You Choose?

Here are a few general rules:

Go for sector funds if:

-

- You have a short-to-medium term perspective.

- You have good knowledge of a particular sector.

- You can get out when the industry peaks.

Select thematic mutual funds when:

-

- You desire sector exposure with a unifying concept.

- You hold long-term economic changes.

- You are looking for moderate diversification.

Still puzzled? Our advisors at VSRK Capital can assist you in matching your fund choice with your financial objective and risk tolerance. Contact our advisors today.

Things to Consider Before Investing

Before you include sectoral or thematic funds in your portfolio, remember these considerations:

-

- Your Risk Tolerance: Both have high risk.

- Investment Horizon: Thematic funds demand longer horizons.

- Market Timing: Critical for sector funds.

- Regular Review: Review sector and theme performance quarterly.

- Asset Allocation: Do not over-tilt in one theme or sector.

A solid portfolio strategy combines core diversified funds with a tactical allocation to sector funds or thematic mutual funds.

Final Thoughts: Expert Guidance is Key

Sectoral mutual funds and thematic mutual funds can be rewarding—but only when selected with proper understanding and timing.

Don’t make these your main investments. Rather, view them as tactical plays to boost your core portfolio.

We at VSRK Capital provide professional, impartial mutual fund advisory solutions that meet your risk tolerance and objectives. Whether you wish to introduce a high-growth industry fund or invest in an exciting thematic fund, we’re at your service to guide you in the right direction.

For exploring your choices, go to our website, VSRK Capital, or obtain personalized assistance by connecting with our contact page.

You may also look at our Google Business Profile reviews and ratings to view how we have assisted thousands of investors like yourself in wealth creation judiciously.

Sector and Thematic Mutual Fund FAQs

-

- Are sector funds long-term investor-friendly?

Not necessarily. Because they’re cyclical in nature, sector funds are more suitable for short- to medium-term bets. - Is SIP possible with thematic funds?

Yes, thematic mutual funds are suited for SIPs if you expect the long-term growth of the theme. - Which is more riskier sector or thematic funds?

In general, sectoral mutual funds are riskier because they are narrowly focused. - Should I have both in my portfolio?

Yes, if your portfolio is diversified, a small exposure to both can provide tactical benefits.

- Are sector funds long-term investor-friendly?

If you’re ready to invest in your next intelligent financial move, come to VSRK Capital and look at mutual fund investments tailored specifically to you.