Table of Contents

ToggleLumpsum Investment is one of the effective ways an investor can create wealth. While SIPs (Systematic Investment Plans) are widely popular, investing a lump sum amount in one go can be a smart and strategic move—especially when timed correctly.

At VSRK Capital, a Registered Mutual Fund Distributor, we assist investors in making informed decisions to grow their wealth effectively. Here in this blog, we are going to discuss how lumpsum investing works, how it differs from SIPs, and how you can invest lumpsum amounts wisely.

What is Lumpsum Investing?

Lumpsum investing is when a sum of money is invested in a mutual fund all at once, rather than splitting it into smaller periodic installments as in SIP.

This method of investment suits individuals who have just inherited a large sum of money, be it bonuses, inheritances, or the sale of assets.

Typical Situations Where Lumpsum Is Best Suited:

- Receiving an annual bonus

- Selling a house

- Retirement corpus

- Money from inheritance or gifts

Lumpsum Investment in MF: How Does It Work?

Lumpsum investment in MF (Mutual Funds) denotes the one-time investment of a fixed sum of money in a mutual fund scheme.

Initially, you will invest a limited amount in Equity funds, Debt funds, or Hybrid funds—based on your investment goals and personal risk appetite. This is suitable for the long-term investor who can endure short-term volatility in the marketplace, while being able to withstand it for better long-term values.

Benefits of Lumpsum Investment in MF:

1. Time in the Market

Early investing lets your money grow over the years and keeps you safe from bad timing and market speculation.

2. Power of Compounding

One initial early investment can snowball into large amounts of wealth as returns accrue more returns in the long run.

3. Simple Monitoring

With one-time entry, you can monitor performance effortlessly and take care of your investment without any frequent payment schedules on your mind.

Use a lumpsum calculator to estimate the future value assuming a rate of return.

SIP vs Lumpsum Investing: What Should You Choose?

Let us compare SIP vs lumpsum investment and find out what suits your profile:

| Parameter | SIP (Systematic Investment Plan) | Lumpsum Investing |

|---|---|---|

| Frequency | Monthly | One-time |

| Ideal For | Salaried individuals | Individuals having a huge amount to invest |

| Market Timing | Reduces risk through averaging | High if invested at peak, high returns if invested in lows |

| Flexibility | High | Low |

| Return Potential | Consistent | Higher if market trends favor |

Lumpsum and SIP each have their role in a diversified portfolio.

When to Invest Lumpsum in a Mutual Fund?

Time is important, particularly when considering when to invest lumpsum in a mutual fund. Here are optimal situations:

1. Market Correction or Dip

Investing in a correction allows you to purchase units at a lower NAV. This paves the way for favorable long-term returns.

2. Long-Term Horizon

If you can do without the money for the next 5-10 years, lumpsum can be magic thanks to the compounding power.

3. Adequate Financial Position

Before investing substantial amounts of money, ensure your emergency fund, insurance coverage, and debt repayment are taken care of.

Discuss with our experts at VSRK Capital to time your investments.

How to Invest Lumpsum Amount in Mutual Funds

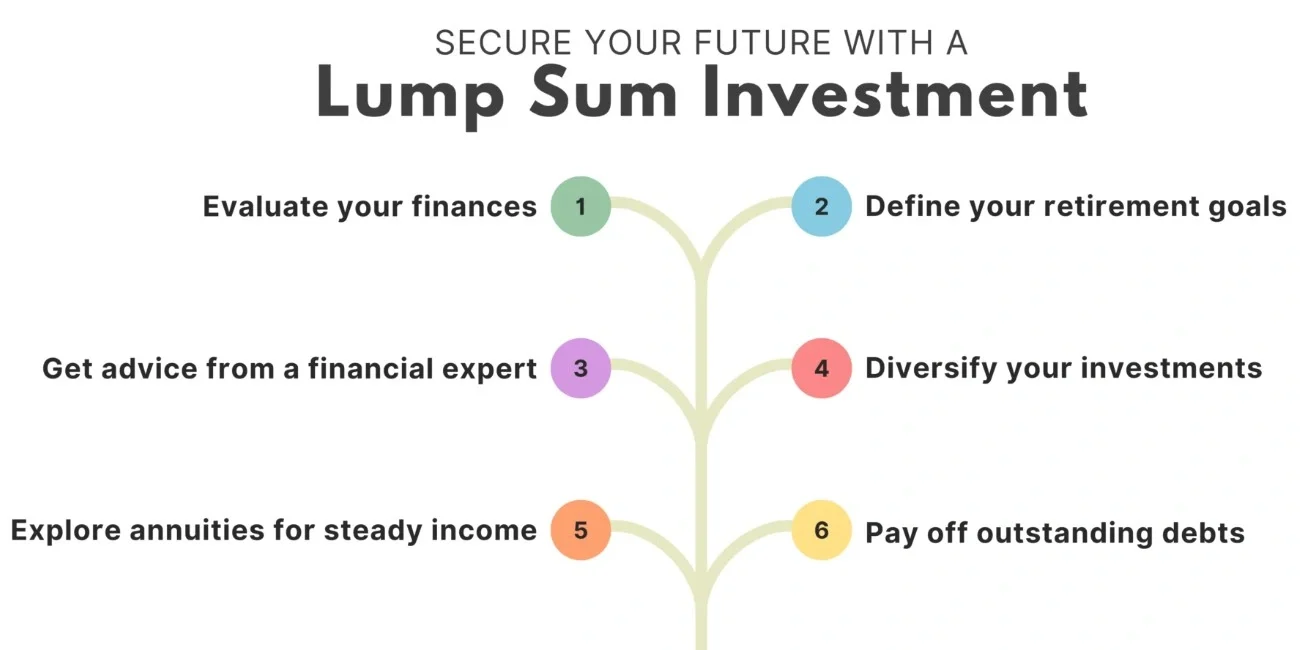

If you’ve been thinking about how to invest lumpsum amount, here are the steps you can take:

1. Set your goals

Before investing through lumpsum, identify your investment strategy, whether it’s building wealth, saving for your child’s education, or developing retirement income.

2. Evaluate Risk Capacity

If you are comfortable with market fluctuations, opt for equity funds. Otherwise, hybrid or debt funds are less risky.

3. Choose the Correct Mutual Fund Scheme

Opt for funds with steady performance, sound fund managers, and lower expense ratios.

4. Opt for STP (Systematic Transfer Plan)

If in doubt, invest in a liquid fund and migrate step by step to equity funds.

5. Meet a Professional

Contact VSRK Capital to avail customized advice and execution support.

Lumpsum Investing Benefits

1. More Returns

Lumpsum investing harnesses complete market potential, particularly in bull runs, and can return more than staggered investments.

2. Single-Time Ease

No need to make periodic payments—invest only once and allow the fund to grow, sparing time and effort in management.

3. Powerful Compounding

Amounts invested compound continuously for a longer duration, accelerating wealth formation through reinvested profits over time.

4. Long-Term Orientation

Suitable for long-term objectives such as retirement or building wealth, where long-term growth and market cycles are supported by the time horizon.

Disadvantages of Lumpsum Investing

1. Risk of Market Timing

Wrong-time investing, particularly at times close to market highs, leads to instant short-term losses and dampened initial confidence.

2. Reduced Flexibility

Lumpsum does not average expenditure like SIP, foregoing opportunities to purchase more in downturns or corrections.

3. Mental Turmoil

Witnessing a big investment size change daily can create tension and encourage rash actions during market volatility.

However, with professional advice from VSRK Capital’s advisory team, these drawbacks can be eased.

Lumpsum Investing Strategy for Various Risk Profiles

Conservative Investors:

- Select debt or hybrid funds

- Utilize STP to shift to equities in a phased manner

Moderate Investors:

- Split between large-cap equity and hybrid funds

- Rebalance every year

Aggressive Investors:

- Invest in multi-cap or mid-cap equity funds

- Invest during market lows for best returns

Use a Lumpsum Calculator Before Investing

A lumpsum calculator assists you in:

- Calculating the future value of your investment

- Planning better as per goals

- Learning how investment through time impacts returns

Resources such as the Groww Lumpsum Calculator and SBI Securities Calculator are fantastic resources.

VSRK Capital: Your Investment Partner

Being an AMFI Registered Mutual Fund Distributor, VSRK Capital provides:

- Comprehensive support in investment planning

- Recommendations of mutual funds based on the risk profile

- Monitoring and rebalancing of portfolios

- Assistance in both SIP vs lumpsum investment

Contact us at our Contact Page to book an appointment for a free consultation or come to our office on Google Maps for customized services.

Final Thoughts

A carefully thought-out lump-sum investment can open doors to long-term wealth if it is tied to your investment goals. Whether you are a new investor or seasoned investor, knowing how to invest through lumpsum wisely and the aid of tools such as the lumpsum calculator can make all the difference.

Ready to make your money grow? Trust VSRK Capital, your professional in mutual funds and investment planning. Schedule a consultation using our contact page or come see us through our Google Business Profile.

Begin your path to financial freedom today—with confidence, clarity, and expert guidance.

FAQs

Yes, if you have a long-term perspective and invest when there are market corrections. It can provide higher returns.

Employ STP, diversify among funds, and seek advice from an expert like VSRK Capital.

It varies according to your income stream and market scenario. SIPs minimize risk; lumpsum performs more effectively in market downturns.

When markets are at lows or during corrections. Entry timing is more important in case of lumpsum strategies.