Money invested in liquid funds can be said to have great liquidity with very small risk and interest return over a savings bank facility, as liquid funds are debt mutual funds that invest in short-term instruments like Treasury Bills, commercial papers, and certificates of deposits. Let us discuss those characteristics, investment benefits in liquid funds, and how liquid mutual funds can rightly fit your requirements.

What Is a Liquid Fund, Anyway?

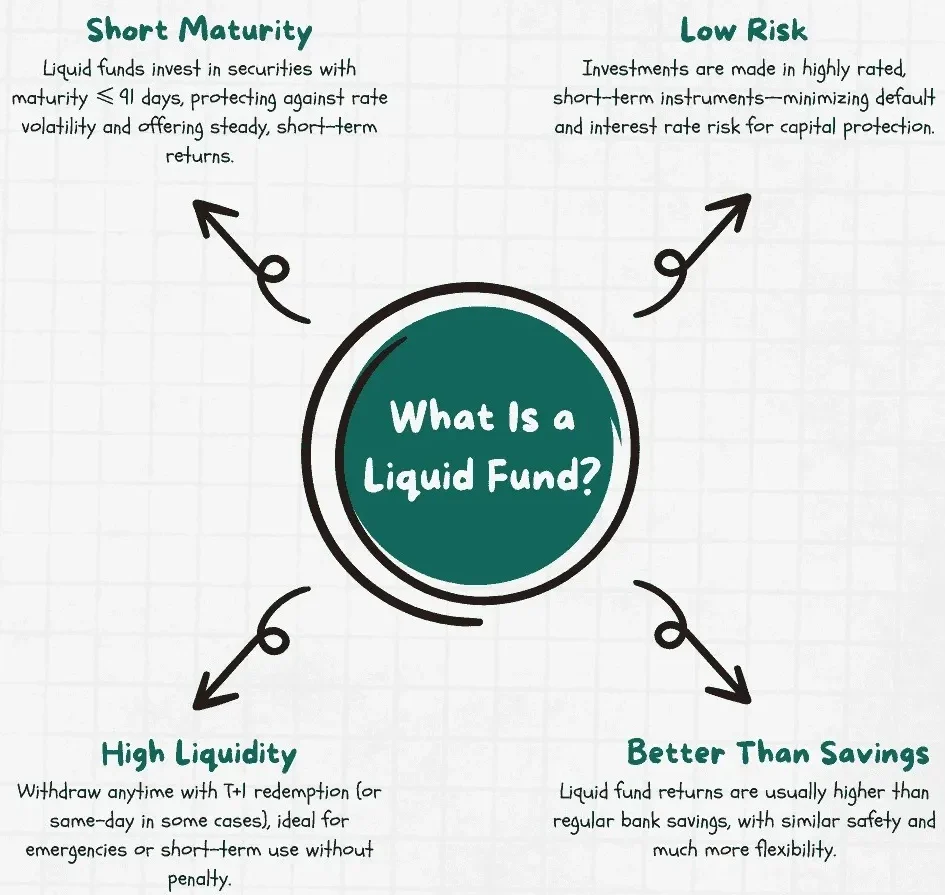

Short maturity:

Liquid funds invest their money in debt securities with maturities of 91 days or less, protecting themselves from interest rate movements and generating stable returns with less volatility, making them ideal for short-term requirements.

Low risk:

As liquid funds are invested in high-rated, short-term securities, they are exposed to low default and interest rate risk. They thus can be considered a low-risk investment for cautious investors requiring capital preservation and stability.

High liquidity:

Investors can redeem their investment in liquid funds quickly, often receiving the funds within 24 hours, making them ideal for emergency needs or short-term cash management without penalties.

Advantages of Liquid Fund Investments

Better Returns Than Savings Accounts

Liquid fund returns typically exceed bank savings rates, giving you more yield on idle money.

Same-Day Liquidity

You can withdraw the amount instantaneously, with no lock-ins, so liquid mutual funds are ideal for unforeseen expenses.

Low Volatility

Invested carefully, a liquid fund sees little price volatility, ensuring your capital is secure.

Tax Efficiency

Short-term capital gains are taxed, but still better off compared to FD interest.

Ideal For Cash Management

Waiting for a lump-sum investment, liquid funds fill the gap safely and effectively.

How Liquid Funds Work

Asset mix:

These instruments, such as government securities, certificates of deposit (CDs), and commercial papers (CPs), are maintained in liquid funds to secure investors, liquidity, and interest risk.

Role of fund manager:

The fund manager achieves portfolio stability by choosing high-grade, short-term securities, balancing safety and return cautiously, and matching with investor liquidity requirements and regulatory requirements.

Fluctuation in NAV

As liquid funds contain securities with extremely short tenors, their Net Asset Value (NAV) fluctuates minimally, providing stable returns and hence suitable for low-risk, short-term investments.

Who Should Invest in Liquid Mutual Funds?

Emergency corpus builders:

Liquid mutual funds are best suited for creating an emergency corpus owing to fast redemption, typically within 24 hours, allowing instant access to funds during medical, financial, or personal emergencies.

Lump-sum investors:

Large-scale investors can keep their money invested in liquid funds temporarily to gain returns as they look for long-term investments or wait for better market conditions.

Salary accounts:

Professionals can utilize liquid funds to set aside excess salary balances, providing a buffer for monthly spending while enjoying higher returns than savings bank accounts.

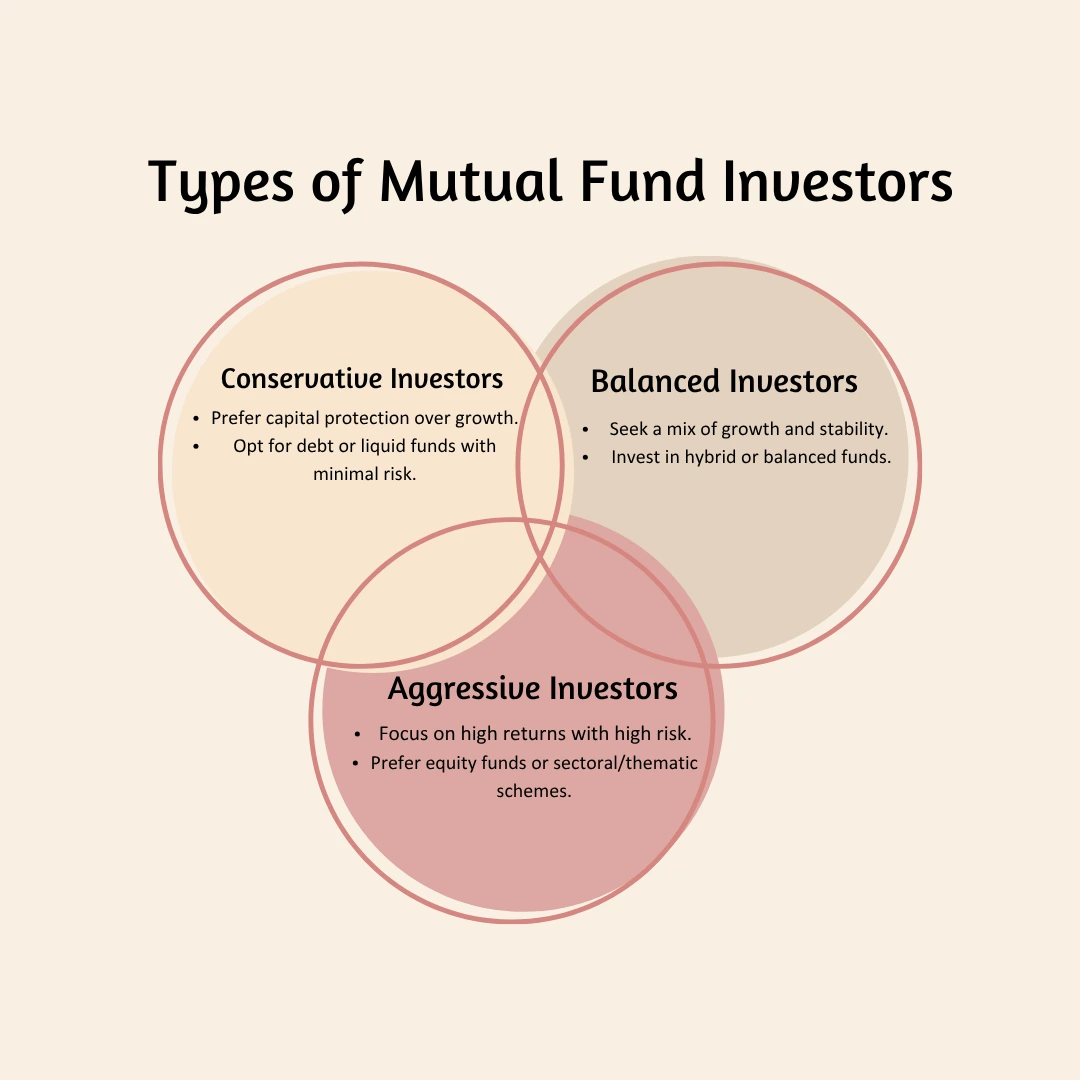

Conservative investors:

Those who shun market risk and desire low-risk capital preservation can opt for liquid funds for steady, small returns without exposure to the direct stock market.

Benefits of Liquid Fund — In-Depth

1. Stability and Security

Liquid funds invest in high-credit-rating products only. The low duration shields against interest-rate shocks.

2. Ease of Access

Liquid funds can be redeemed almost immediately, in contrast to FDs with charges. Liquid mutual funds provide same-day or T+1 redemption.

3. Tax Transparency

Liquid funds demonstrate transparent capital gains taxes. Contrast liquid fund gains with savings account income for transparency.

4. Flexibility

Liquid funds are Perfect for cash cushions. Shift funds seamlessly into long-term schemes.

5. Expert Management

Fund managers manage liquid funds actively for maximum risk-adjusted returns. Investors get the advantage of professional portfolio management.

Comparison of Liquid Funds vs Other Instruments

| Feature | Liquid Funds | Savings Account / Fixed Deposit (FD) |

|---|---|---|

| Liquidity | Redemption in T+0 or T+1 | Partial withdrawal with penalty (FD); Anytime for Savings |

| Returns (FY 2024) | 4–6% p.a. (historical data) | 3–5% (Savings) / 6–7% (FDs) |

| Volatility | Low | None |

| Taxation | Treated as a debt fund – taxed based on holding period | Taxable as per the income slab |

| Use Cases | Parking idle cash, emergency corpus | Daily expenses (Savings) / Short-term goals (FD) |

Risks and Considerations

-

- Credit risk: A small default would affect the returns.

- Interest rate changes: Higher rates will decrease NAV slightly.

- Tax implications: Gains within 3 years are taxed according to income slabs.

- Expense ratio: Even low-cost liquid mutual funds have charges that impact returns.

When to Use Liquid Funds

-

- Creating an emergency fund.

- Parking funds before a large investment.

- Managing salary or dividend receipts.

- Keeping funds for the short term during market dips.

How VSRK Capital Can Help

At VSRK Capital, we facilitate prudent aging of cash via liquid funds:

Expert Guidance: Select proper liquid mutual funds according to your cash flow requirements.

Portfolio Construction: Portfolio with long-term funds to save tax and growth.

Real-Time Rebalancing: Track and rebalance your liquid fund exposure concerning changing goals.

For personal advice, contact us or visit our Google Business Profile.

Common FAQs

What is a liquid fund?

A debt fund with investment in highly liquid financial instruments for short-term financial requirements.

What are the benefits of a liquid fund?

Pockets higher returns than bank deposits, low risk, same-day liquidity, and expert management.

Are liquid mutual funds secure?

Generally secure, but not riskless—credit and interest rate changes can impact returns to a minimal extent.

Can I keep emergency funds in a liquid fund?

Yes, due to their high withdrawal facility, they are best suited for emergencies.

How are liquid funds different from overnight funds?

Liquid funds have up to 91 days of maturity, while overnight funds work on one-day instruments alone.

Conclusion

Liquid funds provide an astute, versatile means of handling short-term cash at a better-than-savings interest, and so are an indispensable component of any portfolio. With the benefits of liquid fund investment, such as stability, liquidity, and transparency, these instruments fill the gap between cash and structured investments.

VSRK Capital helps you choose the most suitable liquid mutual funds for your requirement—either creating a corpus for emergency needs or holding out for a better opportunity. Go to VSRK Capital and discover more, and begin wisely managing your short-term money.

What’s Next

-

- Determine your cash-buffer requirement and time frame.

- Compare fund performance and returns data.

- Automate investments into a liquid fund for regularity.

- Blend with long-term schemes for balanced growth.