Table of Contents

ToggleEquity Share and Preference Share are both basic building blocks in the creation of a stable investment portfolio. Both terms are most commonly used when describing stock markets and shares in companies and are extremely crucial to company finance. The benefits and drawbacks of equity shares enable investors to make wise investment choices and select the most appropriate investment strategy.

In this comprehensive blog, we will discuss equity shares and preference shares, equity share capital vs. preference share capital, pros and cons of equity shares, and cracking special terminologies such as cumulative shares and non-cumulative preference shares.

Let us reveal the differences and make informed investment choices with expert advice from VSRK Capital, a reliable Registered Mutual Fund Distributor.

Understanding Equity Share and Preference Share

Let us first define equity shares and preference shares, meaning before discussing the differences.

Equity Shares Meaning

Equity shares or ordinary shares are shares indicating ownership of a company. The equity shareholders are promised:

- Voting rights

- Non-fixed dividends

- A share in the residual profits and assets

Equity shares are a favorite investment vehicle for those interested in long-term capital appreciation and the creation of wealth through ownership in a company.

Preference Shares Meaning

Preference stock or preference shares offer investors a definite dividend before any dividend is distributed to equity holders. Though they don’t generally have voting powers, they enjoy preference in:

- Payment of dividends

- Repayment of capital in case of liquidation

We have cumulative and non-cumulative preference shares among preference shares, which we shall discuss in detail in the following sections.

Equity Share Capital and Preference Share Capital

Equity Share Capital

This is the amount of capital raised by a company by issuing equity shares. This represents the common shareholders’ interest in the business.

Preference Share Capital

This is the amount of capital raised under the preference shares, providing a fixed dividend with priority in payment. It appeals to those preferring stability rather than high returns.

Both equity share capital and preference share capital constitute a company’s share capital, which affects its governance, financing, and profit distribution plan.

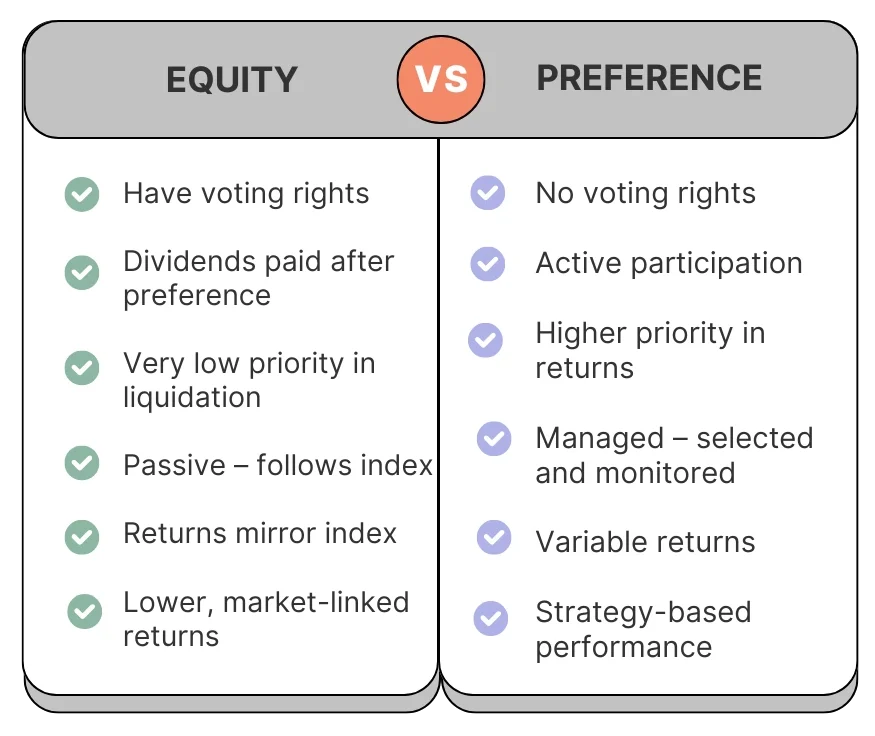

Main Differentials Between Equity Share and Preference Share

A side-by-side chart of the main differentials follows:

| Feature | Equity Share | Preference Share |

|---|---|---|

| Dividend | Variable & not certain | Fixed & preferential |

| Voting Rights | Yes | Typically No |

| Risk | Higher | Lower |

| Returns | High (in favorable market conditions) | Stable |

| Liquidation Priority | Last | First |

| Suitability | Growth-oriented investors | Income-oriented investors |

This comparison points out that equity share and preference share meet different investor needs depending on risk tolerance and financial objectives.

Types of Equity Shares

Different types of equity shares are issued for different purposes:

Bonus shares: Distributed free of cost to existing shareholders.

Sweat equity share: Awarded to employees for their effort.

Right shares: Issued to existing shareholders at a reduced price.

ESOPs: Issued under employee stock ownership schemes.

Every category depicts advantages and disadvantages of equity shares towards rewarding stakeholders and mobilizing funds.

Types of Preference Shares

Preference shares can be categorized into different types:

1. Cumulative Preference Shares

In case a company is unable to pay dividends, they are carried forward and settled at a later date.

2. Non-Cumulative Preference Shares

If a firm overlooks the dividend in one year, it’s gone forever.

This difference between cumulative and non-cumulative preference shares is crucial while analyzing return reliability.

3. Participating Preference Shares

Apart from fixed dividends, the holders are given a portion of surplus profits.

4. Convertible Preference Shares

These are convertible into equity after a period or at the option of the company.

Each form of preference suits different risk-return profiles and investment requirements.

Advantages and Disadvantages of equity shares

| Equity Share Pros | Equity Share Cons |

|---|---|

| Voting Rights: Power over management decisions. | High Risk: No guaranteed return; losses in downturns. |

| High Return: Potential for high gains in markets. | No Fixed Income: Dividends may fluctuate or stop. |

| Bonus & Dividend Income: Extra via bonus/profits. | Dilution Risk: New shares may reduce ownership. |

| Liquidity: Easy to trade on public exchanges. | Performance-Based: Returns depend on company success. |

| Capital Appreciation: Ideal for long-term growth. |

Knowing the pros and cons of equity shares equips investors with the knowledge to match expectations with reality.

When to Opt for Equity or Preference Shares?

Opt for Equity Shares If:

- You require long-term growth of capital

- You can bear market volatility

- You wish for ownership and right to vote

- You are investing in stock markets actively

Opt for Preference Shares If:

- You desire stable returns

- You want less risk

- You are a passive investor

- You desire preference in payment of dividends and return on capital

Real-World Example: Investing in Equity and Preference

Let’s consider a company issuing two kinds of shares:

Equity Shares at ₹100 – No assured dividend but possibility of capital appreciation.

Preference Shares at ₹100 – 8% dividend per annum, but no right to vote.

An investor who is interested in growth would opt for equity, while one interested in fixed income would opt for preference stock.

Thus, a preference share or equity share option is based on your investment goals and risk-bearing ability.

What Should Investors Keep in Mind?

Consider these points before investing in Equity Share and Preference Share:

- The fundamentals of a Company: Profitability, growth prospects and debt position

- Dividend history: especially for preference shares

- Redemption clause: for redeemable preference shares

- Taxation: Dividend and capital gains tax effect

Our lock-in period, if imposed on certain types of shares

How VSRK Capital Can Assist

We at VSRK Capital assist you in making the correct investment choice, be it investing in equity shares or obtaining fixed returns from preference stock.

We assist with:

- Portfolio planning for your needs

- Risk profiling to direct asset allocation

- Periodic investment plans such as SIPs

- Rebalancing advice on strike and preference instruments

Visit our services here: VSRK Capital Homepage

Need a personal touch? Contact us directly: Contact Page

Or drop by our branch: Google My Business Listing

Conclusion

To know the equity share and preference share composition is important in order to make intelligent investment decisions. From voting right to dividend composition, both possess special benefits.

Whether you are considering cumulative and non-cumulative preference shares, knowing equity shares and preference shares meaning or deciding between equity share capital and preference share capital, always reconcile your choice with your financial objectives.

For expert assistance in making sense of the world of mutual funds and shares, rely on VSRK Capital, your reliable investment planning partner.

FAQs on Equity Share and Preference Share

Equity shares give ownership and voting rights, while preference shares give fixed dividends and seniority in repayment of capital.

Yes, preference shares are less risky because they have fixed returns and lower volatility.

Certain convertible preference shares can be converted into equity after a certain period.

Equity shares are more appropriate for long term capital appreciation, whereas preference shares are suitable for regular income.