In today’s time, it is easy to talk about female freedom, male-female equality, and women empowerment. We all hope for change in society through well-established policies. But can there be freedom without financial independence? These are some of the steps that every woman should follow to ensure long term financial independence. The American association of university women estimated the 2018 “gender wage gap” to be at 18%- on average most women earn 82% only for every dollar earned by a man.

Plan a budget

Well, a budget is an estimation of your income and expenses. Create a monthly expense list containing bills, fees, rent, groceries, and others. Women empowerment has come a long way a lot to develop regarding finances. That development will start from your small initiatives in which budget formation is the initial step.

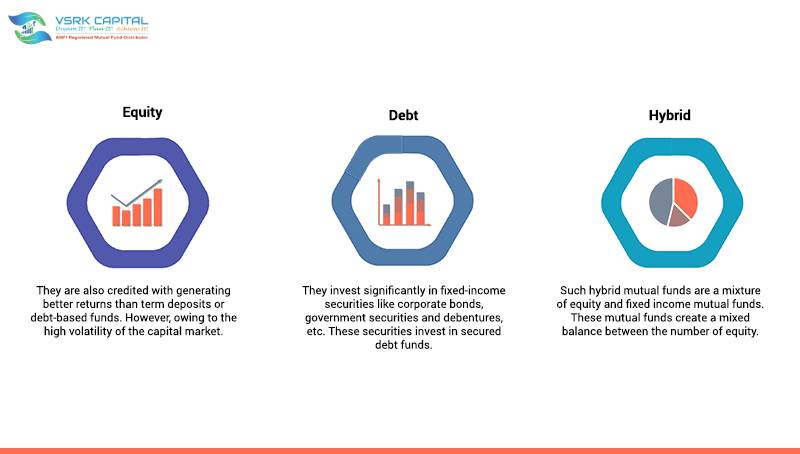

Be obsessed with your investment

Investments are beneficial over short as well as long term returns. Every woman should keep herself first and should think about her financial security. Start investing early in mutual funds. You can start as low as INR 500 per month. This amount will be useful in the future. You plan to buy a house, or to travel, your child’s education or marriage. Investing in gold is also beneficial and proves to be a smart move.

Manage your finances

If you are a single woman, there are chances that you have already taken responsibility for your finances. If you are married, you should prepare to take responsibility for your money flow rather than depending upon your husband or in-laws. Be financially independent on your terms. Your financial ability will help you to achieve your dreams.

Be debt free

Even people with high paying jobs cannot support themselves financially. It is because, from head to toe, they are under the debts. The main reason is unequal pay. Many women take loans and spend more than they can afford. Everyone wants to live a luxurious and healthy life when they can’t afford their desires often lead to debts. Limit your spending habits will help a lot.

Earn, save and invest

Even after having a good income one should need to focus on wealth and try to earn more and more wealth so that it becomes easy to fulfil all the demands of you and the members of your family. On the other hand, you need to save at least some part of your income for further expenses. If you invest in some long-term or short-term securities, you can earn a good profit that can be a part of your income that could be useful for future purposes.

Hiring a financial planner

It is necessary to have a financial plan so that your investments can meet your goals. A financial planner can set up a plan based on your money flow. It is suggestible that people should control their expenses efficiently to meet their financial objectives. In the end, we can say that every woman must be financially independent that will help her in chasing her dreams and making her satisfied.