Table of Contents

Toggle

These low-risk mutual funds offer the advantages of both debt and equity, making them a balanced yet attractive option with a mixed risk profile. As an entry-level investor or in case you want to diversify your portfolio, hybrid funds provide a one-stop scheme that adapts according to your financial goals.

Let’s go through what is hybrid fund is, its composition, benefits, and who can invest.

What is a Hybrid Mutual Fund?

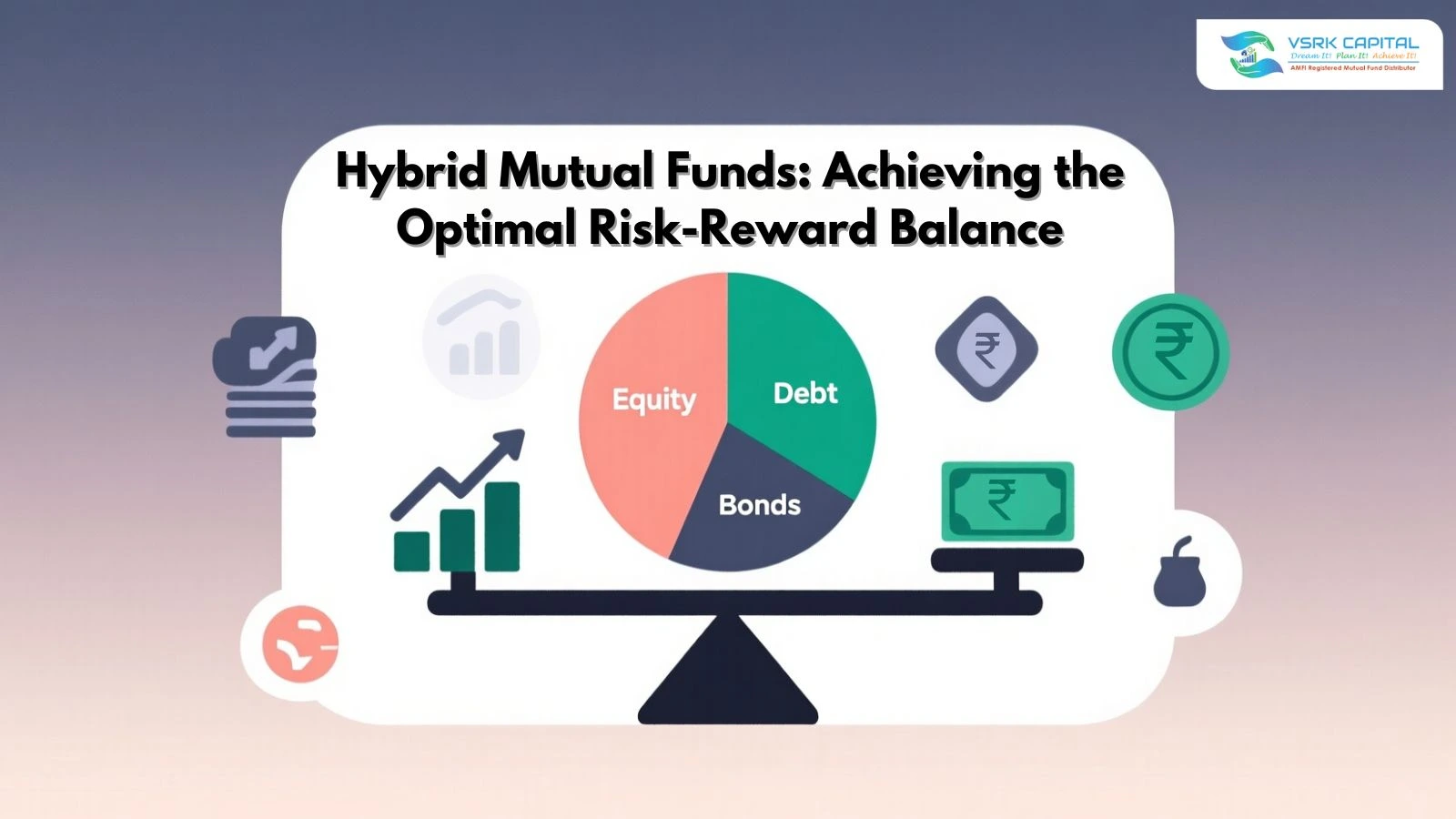

A hybrid mutual fund invests in equity and debt securities. These low-risk mutual funds aim to earn both capital appreciation and income by investing in high-paying equity and secure debt securities.

What is a Hybrid Fund?

1. Balanced Growth

This approach balances the potential for high growth with the consistency of debt, resulting in a balanced and relatively risk-managed approach to risk and returns.

2. Volatility Control

Debt bufferings against equity market volatility enable investors to survive temporary volatility without panicking.

3. Please Moderate Risk Takers

Best for investors who want more returns than pure debt but can’t stomach high equity risk completely.

These low risk mutual funds provide a balanced approach, particularly for those who don’t want full exposure to equity or solely debt.

Types of Hybrid Funds

Understanding the types of hybrid funds that direct investors in choosing the right product as per their financial goals.

1. Conservative Hybrid Funds

- Invest large amounts in debt securities (75-90%) and a small amount in equity (10-25%)

- Low risk, stable returns

- Ideal for income-seekers, low-risk mutual funds for 3 years

2. Aggressive Hybrid Funds

- Invest not less than 65% in equity and the rest in debt

- Higher potential returns with medium risk

- Best for investors looking for a mutual fund for 3 years or above

3. Equity-Oriented Hybrid Funds

- As aggressive as an aggressive hybrid, but more equity oriented

- More risk but better long-term growth in capital

4. Debt-Oriented Hybrid Funds

- Invest more in debt than equity

- Lower risk with decent growth in capital

- Short to mid-term goals are perfect for them

5. Multi-Asset Allocation Fund

- Diversified in at least three asset classes (equity, debt, gold, etc.)

- Reduces dependence on a single market.

Hybrid Mutual Funds Key Features

- Risk and Return Balance

- Combines debt elements for stability and equity elements for growth.

- Flexibility

- Can be utilized for mutual funds for one year or long-term investment, depending on allocation.

- Fund Manager Expertise

- Handled by experts who tactically rebalance between debt and equity based on market cycles.

- Customizable Risk Profiles

- Risk-taker or conservative investor, there is a hybrid fund that suits your requirements.

Advantages of Investing in Hybrid Funds

Below are sound reasons why it is a good idea to invest in hybrid funds:

1. Diversification

- Exposure to debt and equity funds

- Reduces overall portfolio risk

2. Periodic Income + Build-up of Capital

- Debt portion offers periodic income

- Equity portion builds wealth over time

3. Tax Efficiency

Long-term capital gain (LTCG) on equity-oriented hybrid funds is taxed as equity

4. Professional Management

A skilled fund manager actively manages the portfolio depending on market conditions

5. Accessibility

Best fit for new investors who are looking at mutual funds of 1 year or more

Is a Hybrid Fund the Right Choice for You?

You can consider hybrid mutual funds if you:

- Are new to the world of mutual funds

- Are looking for a low risk mutual fund for one year with decent returns

- Want to invest in a 1-3 year time frame

- Are you saving for short-term goals like vacation, gadget purchase, or wedding

- Are you a retiree seeking low volatility with some growth

Risks to Consider

- Equity market risks: Despite the cushion of debt, aggressive hybrid funds tend to be volatile

- Interest rate risks: The Debt component can go up and down with interest rate movements

- Credit risk: Particularly in investing in debt with lower-rated securities

- Always determine your risk tolerance before selecting a particular hybrid category.

Hybrid Funds Investment: How to Start

Visit VSRK Capital – Our AMFI-registered VSRK Capital team helps you choose the best types of hybrid funds

Contact Experts – Call through our Contact Page for personalized guidance.

Google My Business – Read reviews and visit us on Google My Business for directions and inquiries.

We offer detailed guidance on hybrid mutual funds if you are searching for mutual funds for 3 years or beginning with SIPs.

Comparison with Other Mutual Funds

| Criteria | Hybrid Mutual Fund | Equity Fund | Debt Fund |

|---|---|---|---|

| Risk | Moderate | High | Low |

| Return Potential | Moderate to High | High | Low to Moderate |

| Ideal For | Balanced Investors | Growth Seekers | Safety Seekers |

| Investment Horizon | 1–3+ Years | 3+ Years | Less than 3 Years |

Taxation on Hybrid Mutual Funds

- Equity-oriented hybrid funds: LTCG taxed at 10% if gains exceed Rs. 1 lakh

- Debt-oriented hybrid funds: Taxed as per income slab for STCG; LTCG at 20% with indexation

Tips Before You Invest

1. Align Goals

Select hybrid fund categories appropriate to your time horizon, risk tolerance, and financial objective—short or long-term.

2. Invest via SIPs

Start with SIP to benefit from rupee-cost averaging and avoid market timing risk effectively.

3. Review Portfolio Annually

You typically want to review your mutual fund portfolio every year, and adjust your equity-debt ratio back to a desired ratio, as well as be open to adjusting it based on changes in goals, risk tolerances, and market swings.

4. Bank on Seasoned Managers

Select funds handled by experienced, well-established fund managers with consistent past performance and clearly defined approaches.

Last Words

Hybrid mutual funds are a clever way to invest since they add a layer of safety to your investments and/or give you more return. For every risk profile and every time horizon, there are choices for these mutual funds. They work for conservative investors and moderate investors.

Whether your investment cycle is 1 year or 3 years, hybrid mutual funds can have a niche in your strategy.

Ready to invest in hybrid mutual funds? Talk to our advisors at VSRK Capital and create a plan based on your needs.

Get in touch by visiting our contact page or looking for us on Google.

FAQs

A hybrid fund is a mutual fund invested both in debt and equity, wherein risk and returns are well balanced.

Yes, especially conservative hybrid funds may be used as mutual funds for one year or short-term mutual funds for 3 years.

Aggressive hybrid funds are best suited for 3-year mutual funds, with a mix of growth and security.

Absolutely. They are low-risk mutual funds, offering stability and simple entry for new investors.